Last updated: July 13, 2024 at 8:39 AM

Last updated: July 13, 2024 at 8:39 AM

In the future, I will no longer be able to live on my pension alone, so I will take the plunge and cancel my fixed deposit. New NISA I decided to start.

The time deposit was with Japan Post Bank, but when I looked at my passbook, the interest rate was only 0.01% (0.07% for a 5-year term from January 15, 2024), so I don't think there was any point in letting it sit in the first place.

In this article, I, an amateur, take on the challenge of investing. Opening a NISA securities account From Purchase of investment trust stocks We will explain the details of the steps leading up to the start of operation in chronological order.

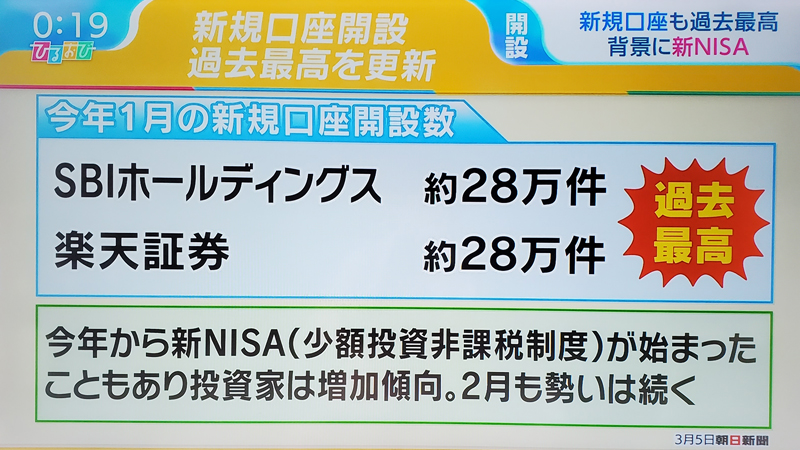

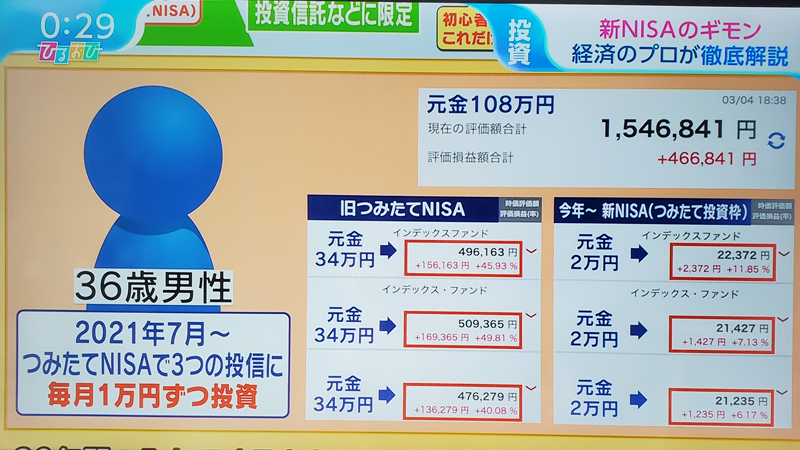

- For the explanation of this article, I referred to Microsoft Bing's AI chat COPILOT and the TBS lunchtime information program "Hiruobi" broadcast on March 8, 2014, and also used the program's flip.

About NISA

NISA is an abbreviation for "Nippon Individual Savings Account".

This is a Japanese version of a tax-free system for small investments modeled after the UK's Individual Savings Account (ISA).

This system is an investment framework introduced by Japan's Financial Services Agency with the aim of supporting individuals' asset formation by exempting dividends and sales profits from investments in financial products such as stocks and investment trusts. It's a system.

As a general rule, only one NISA account can be opened per person.

In other words, a person cannot have multiple NISA accounts. However, general NISA and Tsumitate NISA can be opened separately.

Below are the main points of the new NISA starting in 2024.

- Indefinite tax-free holding period: Unlike previous NISAs, the tax-free holding period can be extended indefinitely.

- Permanent account opening period: The period for opening an account will become permanent.

- You can use both the accumulated investment limit and the growth investment limit: You can use both limits to increase your investment amount.

- Expansion of annual investment limit: The accumulation investment limit is 1.2 million yen per year, and the growth investment limit is 2.4 million yen per year, making it possible to invest up to a total of 3.6 million yen per year.

- Tax-free holding limit: 18 million yen in total (12 million yen for growth investment limit)

When you open a NISA account, it is a system where profits earned from financial products such as stocks and investment trusts purchased up to an annual limit of 3.6 million yen (1.2 million yen accumulated investment limit + 2.4 million yen growth investment limit) are tax-free.

The new NISA targets certain investment trusts and listed stocks that are suitable for long-term savings and diversified investments. This system is available to investors over the age of 18, and products invested with the current general NISA and Mitate NISA can also receive tax exemption under the new system.

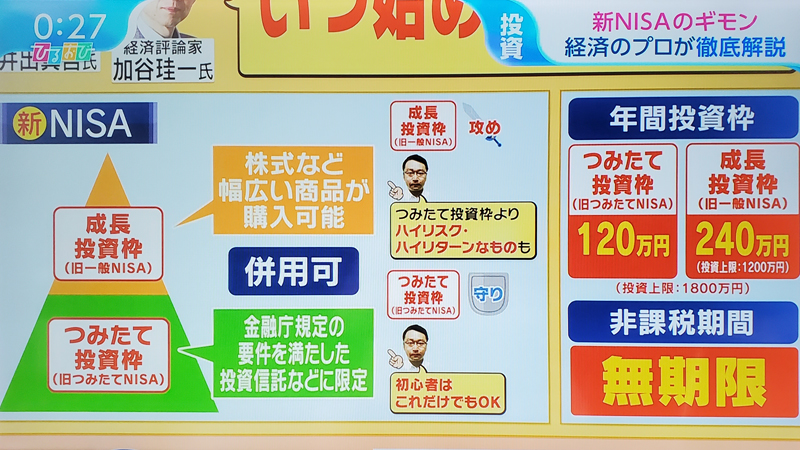

New NISA accumulation investment limit and growth investment limit

The main differences between the new NISA's accumulation investment limit and growth investment limit are as follows.

- Fresh investment limit:

- The annual investment limit is 1.2 million yen.

- Target products are investment trusts suitable for long-term, accumulated, and diversified investments.

- Investment products are limited to investment trusts and ETFs (exchange traded funds) selected by the Financial Services Agency.

- growth investment frame:

- The annual investment limit is 2.4 million yen, which is larger than the accumulated investment limit.

- In addition to investment trusts, you can invest in a wider range of products, including domestic and foreign stocks and ETFs.

- It can be used in conjunction with the accumulated investment limit, allowing you to invest up to 3.6 million yen per year tax-free.

The savings investment framework specializes in cumulative investments aimed at long-term asset formation, while the growth investment framework provides more investment options and a larger investment framework, allowing for lump-sum investments as well as savings investments. Is possible. By using either framework, you will be able to operate flexibly according to your investment style.

In addition, in the growth investment framework, it is safe for beginners to avoid purchasing individual stocks and choose investment trust products that entrust the management of stock investments to professionals.

Is the new NISA recommended for preparing for retirement?

The new NISA is an option for preparing for retirement. Below are its advantages and precautions.

【advantage】

Tax-free investment: With the new NISA, invested assets can be held tax-free, which is useful for building future assets.

Unlimited tax-free holding period: Unlike previous NISAs, the tax-free holding period can be extended indefinitely.

Expansion of annual investment limit: You can invest up to 3.6 million yen per year, which can be used to a sufficient extent for building assets for retirement.

【important point】

Understanding Risk: Investing involves risk. Care must be taken in selecting investment products and managing risks.

Long-term perspective: The new NISA is suitable for long-term savings. Please consider using it for short-term purposes.

Need for investment knowledge: Investing requires basic knowledge. Make use of appropriate information gathering and advice.

When considering a new NISA to prepare for retirement, we recommend that you consider your investment objectives and risk tolerance and seek professional advice.

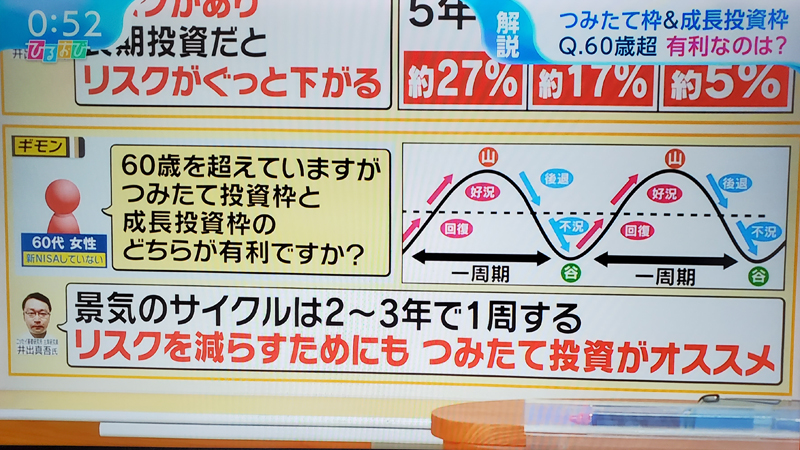

Broadcast on March 8, 2014 According to an explanation by Shingo Ide of the Nissay Research Institute who appeared on the TBS lunchtime information program "Hiruobi," as shown in the flip, the economic cycle lasts 2 to 3 years. It takes one week, so in order to reduce risk, beginners are recommended to invest in freshly made investments.

In this case, the longer the investment period, the better; statistics show that the risk will be reduced to about 27% in 5 years, 17% in 10 years, and 5% in 15 years or more.

In addition, investment investment uses a method called dollar-cost averaging that reduces the impact of price fluctuations, so even beginners tend to be able to reduce risk.

Finally, in terms of asset formation, young people have principal guarantees. iDeCo(Individual Defined Contribution Pension) is also an option.

Regarding the pension deferral issue

If you do not receive your old-age basic (welfare) pension at age 65, but defer it between age 66 and age 75, you can receive an increased pension of 8.4% per year.

At first glance, this system seems to be a good way to receive interest without risk, but in this case, the break-even point at an age that exceeds the total amount if you start receiving benefits from age 65 is 70 years old (55 years old). If you move forward by 10 years, you will be 81 years old, and if you turn 75 (by 10 years), you will be 86 years old.

If you're wondering whether you'll be able to stay healthy until this age, and if you're willing to postpone your profits, I think it's possible to take a pension from age 65 and put the money you receive into investment trusts.

However, this option is only applicable to those who are still able to work even after reaching the age of 65, or those who have sufficient funds.

Please note that investment trusts are considered risky assets because they do not have principal guarantees and may lose their principal value depending on market fluctuations. The amount of risk varies depending on the investment target and management policy, but it is important to be aware that there are various risks with investment trusts.

When is the best time to start NISA?

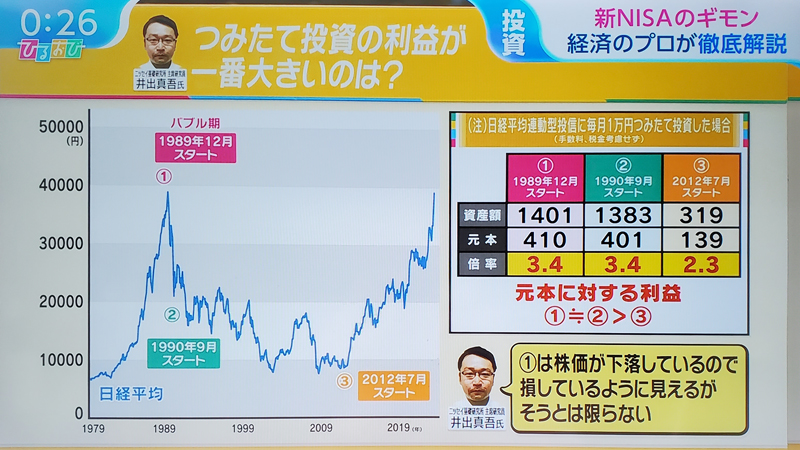

According to the aforementioned Shingo Ide, it is always good to try NISA for the first time.

However, as shown in the above flip, returns are likely to be higher if you start from a time when stock prices are rising (such as during a bubble period) rather than when they are in a slump.

Stock prices rise and fall periodically, so by investing NISA investment trusts over a long period of time (5 to 10 years or more), negative returns will be offset, and as a result, investment risks will be reduced. This is a system in which profits are gradually established as the amount of profits decreases.

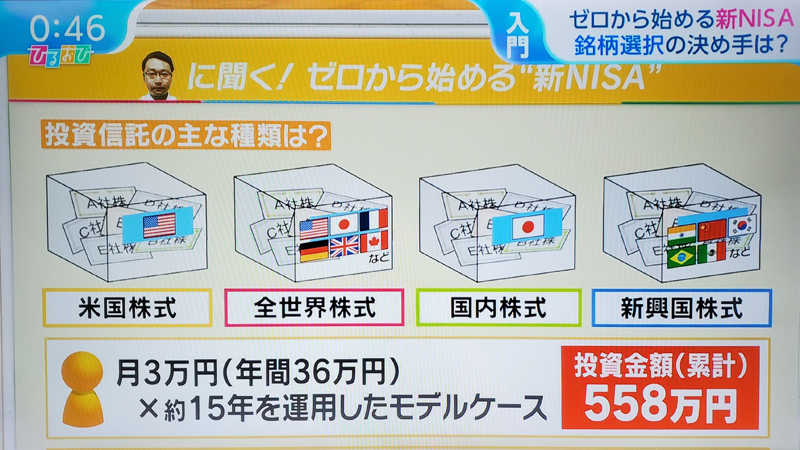

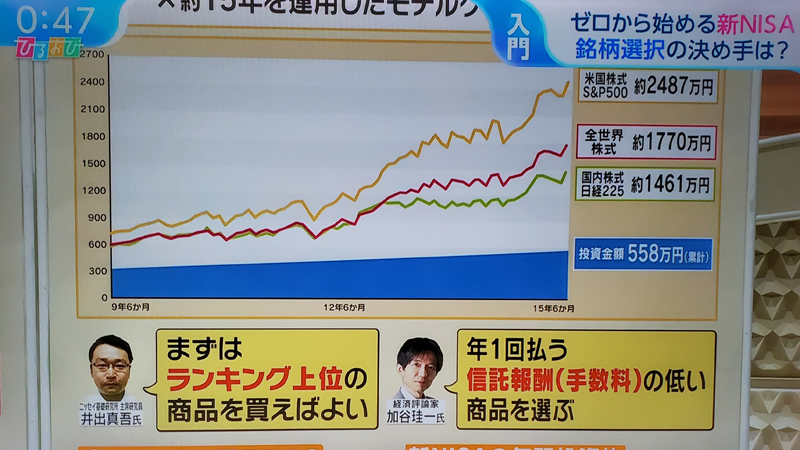

Main types of investment trusts and investment model cases

The above flip is a model case where 30,000 yen per month (360,000 yen per year) x 15 years (total investment amount 5.58 million yen) is invested in global stocks.*

The cumulative investment amount is 5.58 million yen, and it shows that the assets will increase to 17.7 million yen in 15 years.

US stocks account for 60% of all global stocks, and this chart shows that returns are always higher for US stocks than for stocks around the world.

*Note: This is just a success story, and in addition to the characteristics of the fund, stock prices may plummet due to external factors such as the pandemic, the situation in the Middle East, the outbreak of war, Black Monday, the Lehman Shock, the bursting of the IT bubble, the semiconductor recession, and the coronavirus pandemic. If unforeseen circumstances such as this occur, there is a risk that the principal will be lost over several years. You must be aware of the risks involved in investing, and manage your investments at your own risk and within your financial means.

The main types of investment trusts are as follows.

- stock investment trust: Invest in stocks and aim to profit from price increases and dividends.

- Bond investment trust: Invest in bonds issued by countries, local governments, and companies and seek stable yields.

- balanced investment trust: Invest in both stocks and bonds to balance risk and return.

- index fund: An investment trust that is managed to track a specific market index.

- active fund: Managers analyze the market and aim for higher returns than the index.

- REIT (Real Estate Investment Trust): Invest in real estate-related assets and derive profits from rental income and increases in the value of real estate.

These are classified by investment target and investment method, and can be selected according to the investor's objectives and risk tolerance.

What is index investing?

Index investing is an investment method that aims to track the price movements of an index that indicates market price movements, and allows for widely diversified investments in multiple stocks that make up the market.

By investing in a product (such as an investment trust) that aims to track a specific index at a fixed time, such as 10,000 yen every month, you can buy less when the price is high and more when the price is low. there is.

The following are the representative indexes:

Japanese stocks: Nikkei Stock Average (Nikkei 225, Nikkei Average), Tokyo Stock Price Index (TOPIX)

米国株式・・・NYダウ(ダウ平均株価)、S&P500指数、ナスダック総合指数

If you are new to investing, we recommend that you start investing with an index fund that allows for a wide range of diversified investments.

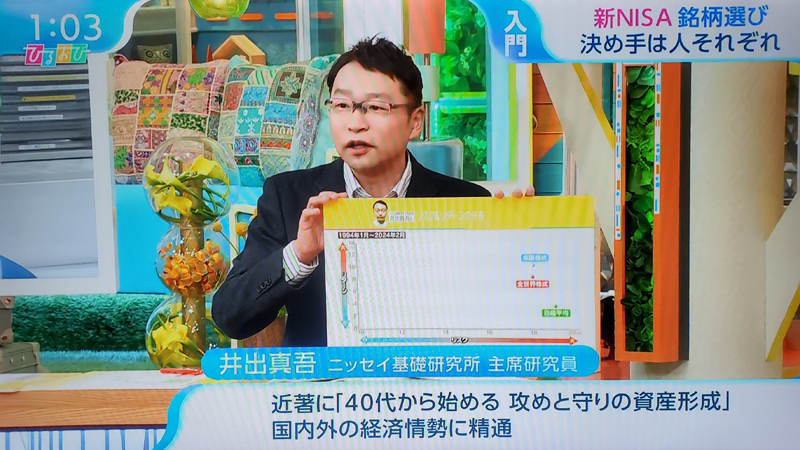

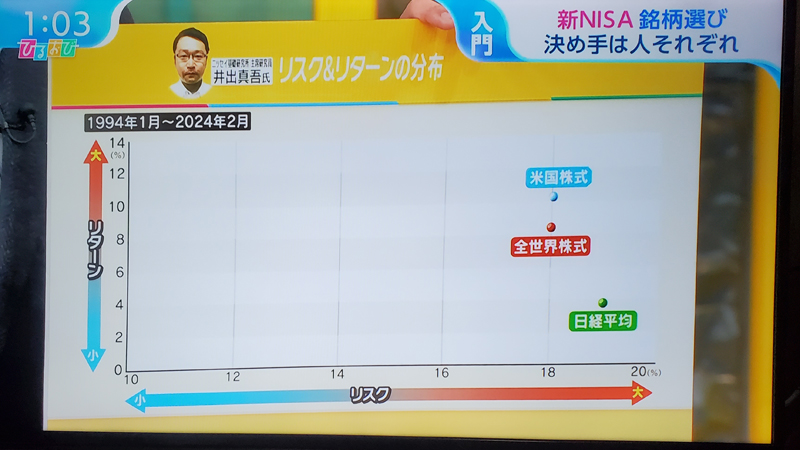

Distribution of risk and return (January 1994 to February 2024)

This flip is the "Risk & Return Distribution (January 1994 to February 2024)" for each stock market compiled by the aforementioned Shingo Ide.

This graph shows that in terms of risk, U.S. stocks and global stocks are not much different, but returns are higher for U.S. stocks.

In addition, according to our research, there was a period in the 2000s (2000-2008) when the return of US stocks dropped significantly to -37.0. Therefore, I think it is important to avoid investing only in US stocks and try to diversify your investments, including stocks around the world.

Regarding the selection of investment trust funds, we also referred to the following ranking site (for the new NISA accumulation investment limit).

The Tsumitate NISA Recommended Ranking (New NISA Saving Investment Frame) uses Minkabu's unique method to calculate the deviation value from six items: yield (return), Sharpe ratio, standard deviation, cost, number of sales companies, and attention level for the past three years. and evaluate it comprehensively.

In addition, I think that the following website "EDES Savings Investment Trust/NISA Savings Simulation" will also be a good reference.

Two benefits you can get from investment trusts

With investment trusts, you can earn two types of profits: capital gains and distributions (income gains). Gains from price appreciation can be obtained when selling an investment trust if the base price at the time of sale is higher than the base price at the time of purchase (sales fees, etc. are not taken into account).

On the other hand, dividends are the money that is distributed to the purchasers of investment trusts from the profits earned through investment. You can earn this if you hold the investment trust as of the closing date, but there is also a ``no distribution'' type that incorporates investment profits into the principal.

Please note that profits earned from investment trusts are subject to approximately 20% tax. However, if you use NISA (Small Investment Tax Exemption System), your investment profits will be tax-free and you can grow your money efficiently.

Investment trusts have fees

There are three fees involved in purchasing and holding mutual funds. The first is the purchase fee (application fee, sales fee), which is a fee charged when making a purchase. Depending on the fund or sales company, this fee may not be charged. The second is the "trust fee (management fee)," which is the fee charged while holding the investment trust.

The third is the ``trust asset retention amount,'' which is the fee charged when selling investment trusts. Depending on the investment trust, it may or may not be subtracted.

Some investment trusts are ``no-load'' types that do not charge purchase fees, so if you choose one of these, you can reduce operating costs. In addition, the amount of trust fees incurred while holding the asset will affect the investment results, so it is a good idea to choose one that is as cheap as possible.

Is it possible to reuse the tax-free allowance when selling items purchased with NISA?

Reuse is possible. NISA is designed to allow you to hold up to 18 million yen based on the acquisition price, and there is no limit to the number of times you can sell it. however,Please note that the acquisition price of the sold item will be available for new investment from the following year onwards.※

※Even if you reuse the tax-free allowance, the annual tax-free investment limit cannot exceed 3.6 million yen (accumulation investment limit of 1.2 million yen, growth investment limit of 2.4 million yen).

If you wish to purchase additional investment trust products beyond the NISA limit, please do so from a specified account (with or without withholding tax). If there is withholding tax, 20.315% tax will be levied on the sale gain.

If the specified account is set up without withholding tax and the profits earned from investment trusts exceed 200,000 yen in a year, you will need to file a final tax return.

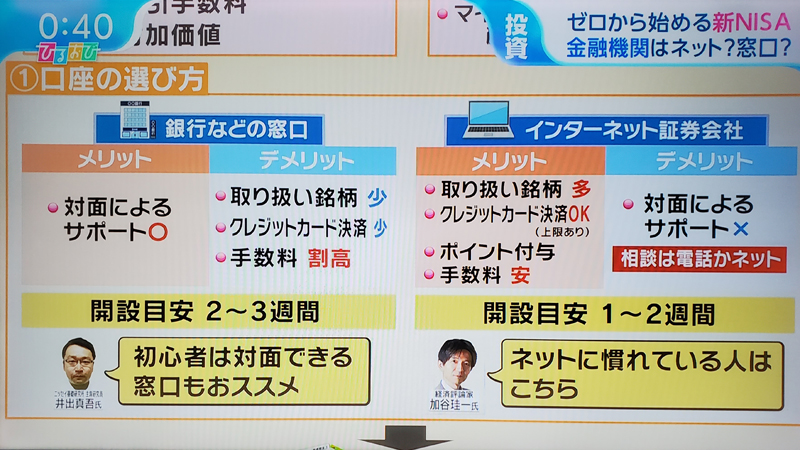

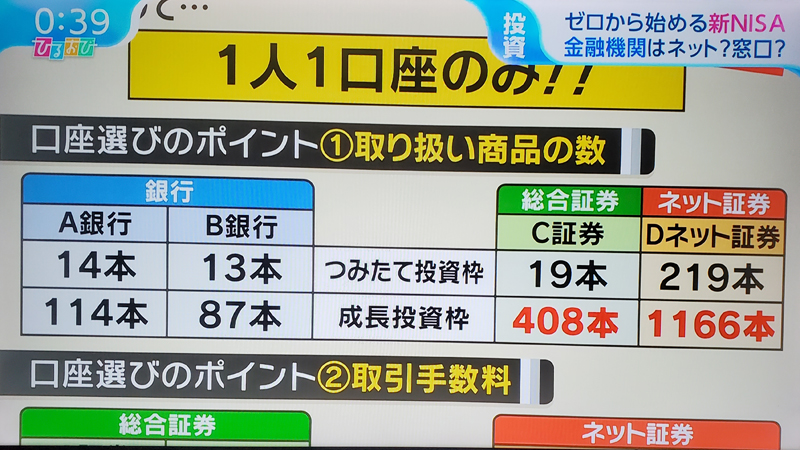

Selection of securities company

To start using NISA, you need to open a NISA account at a securities company. To open an account, you can choose from banks and general securities companies that allow face-to-face consultation, as well as online securities companies such as SBI Securities and Rakuten Securities.

Although face-to-face consultation is not possible with online securities, fees are low, funds can be easily managed through cooperation with online banks, credit card payments are accepted, and added value such as V points, PayPay points, and Rakuten points are available. I'll come.

In addition, it handles more stocks than banks, etc., and SBI Securities in particular boasts the highest number of investment trusts handled among major online securities companies, and is compatible with both the accumulation investment limit and growth investment limit of the new NISA. We handle a large number of stocks, including the current NISA eligible stocks (approximately 230 stocks).

SBI Securities offers a multi-point service where you can select your favorite points from multiple points and accumulate and use them when opening a new account or making various transactions.

In addition to the already provided "T Points", "V Points", "Ponta Points", "d Points" and "JAL Miles", "PayPay Points", a common point service with over 60 million members, has recently been added. has been added to the main points.

By selecting "PayPay Points" on the main point setting screen, you will be able to accumulate "PayPay Points" according to your transaction results, etc. Points are awarded for various transactions, such as 100 points for opening a new account and points equivalent to 0.1% per annum for trading in investment trusts of regular stocks (if the average monthly holding amount of the target fund is less than 10 million yen).

When it comes to online securities, there is also the option of Rakuten Securities, but considering the current situation where the slump in the mobile business is affecting the Rakuten Group as a whole is causing concern, I have excluded it as an option.

For the above reasons, we chose SBI Securities.

The characteristics of SBI Securities can be summarized as follows.

- If you use the Sumitomo Mitsui Card "Platinum Preferred" when purchasing investment trusts, you will get the highest point return rate among online securities companies!

- Trading fees for domestic stocks, US stocks, and foreign ETFs are 0 yen!

- The richness of products and services we handle, from Japanese stocks to foreign stocks, is top class in the industry!

In this article, we will reveal the steps from opening an account to operating it at SBI Securities.

Opening an account with SBI Securities

Opening an account with SBI Securities is easy by accessing the SBI Securities website below and proceeding with the procedure by ``Opening an account online''.

For the screening, you will need to upload the submitted documents (My Number confirmation document + identity confirmation document).

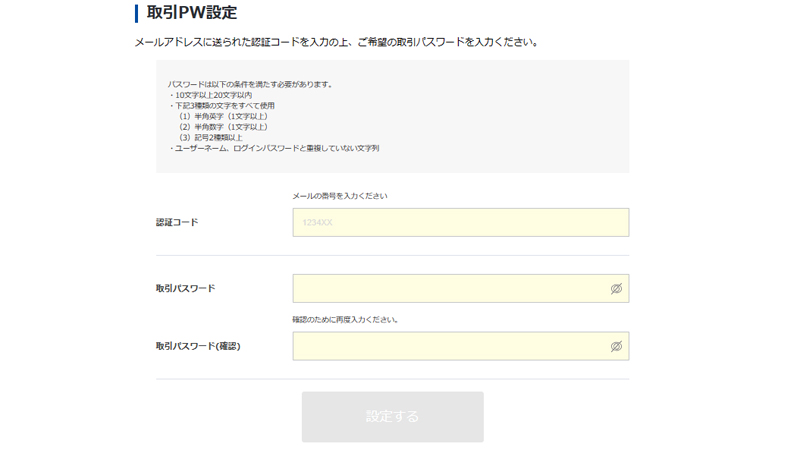

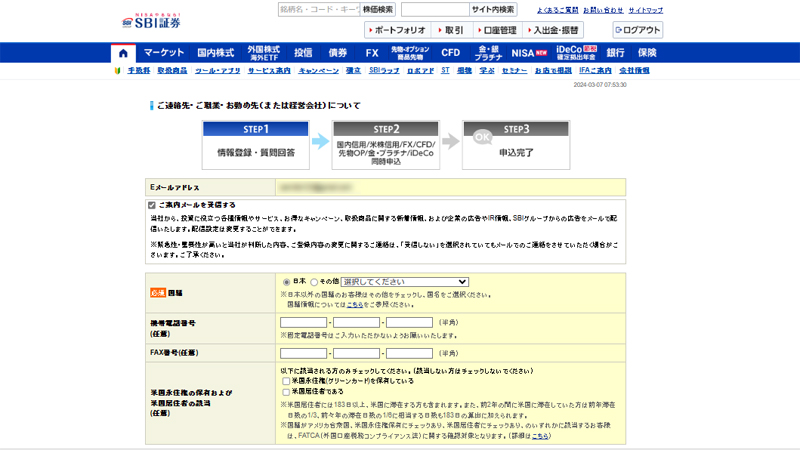

The gallery below shows the flow from setting a trading password to initial settings after completing the SBI Securities review.

You can change the main point by following the steps below.

Select "Account Management" > "Customer Information Settings/Changes" > "Points/External ID Linkage" > "Click here for point service details" > "Main Point Settings"

The main points will be reflected immediately after the procedure is completed. For me, I chose "PayPay Points" as my main point.

Opening an account at SBI Sumishin Net Bank (NEOBANK)

Although not required, at the same time as opening an SBI Securities account. Sumishin SBI Net Bank (NEOBANK) We recommend that you also open an account.

The reason for this is the benefit of being able to use the linked service "SBI Hybrid Deposit".

In addition, the interest rate on ordinary deposits will be 1.5 times higher than normal, making the transfer of funds more efficient, so it is recommended to open them at the same time.

The advantages and disadvantages of "SBI Hybrid Deposit" can be summarized as follows.

【merit】

- The interest rate is 1.5 times (0.03%) higher than the typical savings account interest rate (0.02% per year). *

- Since you can trade securities using your bank account balance, there is no need to deposit or withdraw money from your SBI Securities account, making it easier to transfer funds.

- Clear one of the conditions to increase the number of free ATM/transfer fees (SmaPro rank)

With Smart Pro Rank, anyone can apply Rank 2 (ATM usage: free of charge 5 times a month) by installing the app, logging in, and setting up "Smart Authentication NEO".

【Demerit】

- Unable to withdraw money from ATM (transfer processing to representative account is required)

- Cannot transfer money to other banks

- The current interest rate is 0.03% (April 2024), but other banks are following suit by raising interest rates on ordinary deposits in response to the Bank of Japan's announcement of interest rate hikes, so it cannot be said that the interest rates are significantly high...Example ) Daiwa Next Bank (0.055%), PayPay Bank (0.03%), au (0.3% if conditions are met)*

*Revised on April 1, 2024

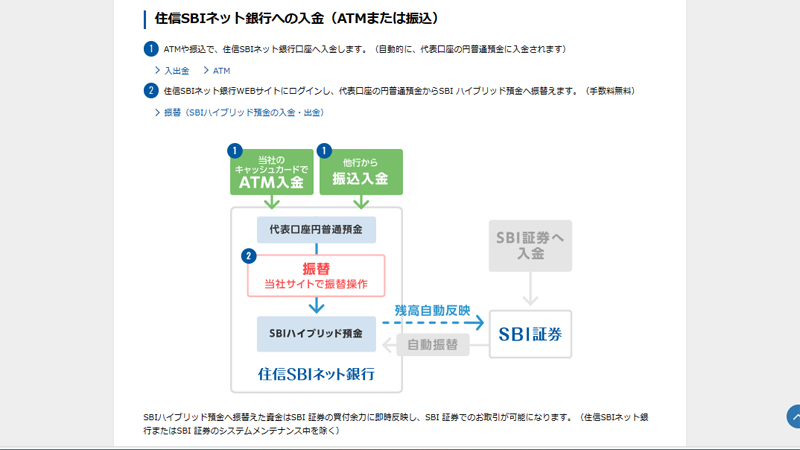

SBI Hybrid Deposit is an image of ``another bank account to keep money for purchasing financial products at SBI Securities'' and is managed separately from Yen Savings Deposit (representative account).

By transferring (transferring) money from the Yen Savings Deposit (representative account), the money will be deposited into the SBI Hybrid Deposit. You can use this money to trade financial products at SBI Securities.

Please note that deposits and withdrawals (transfers) to SBI Hybrid Deposit are free of charge and are covered by the deposit insurance system.

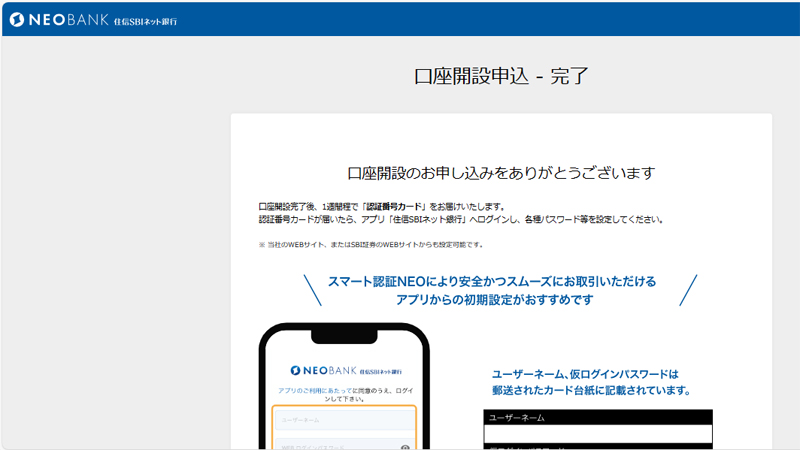

To open an account with SBI Sumishin Net Bank, you can apply for an account from the SBI Securities website as shown below.

After applying to open a NEOBANK account, you will receive an "authentication number card" in about a week. Once it arrives, log in to the "Sumishin SBI Net Bank" app and set various passwords to make your account available for use. Masu.

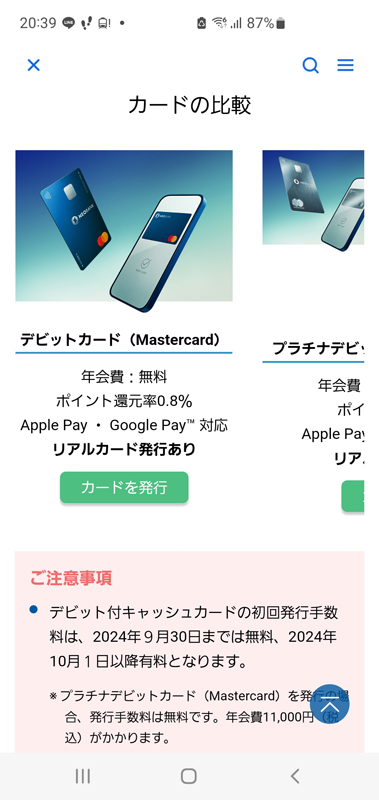

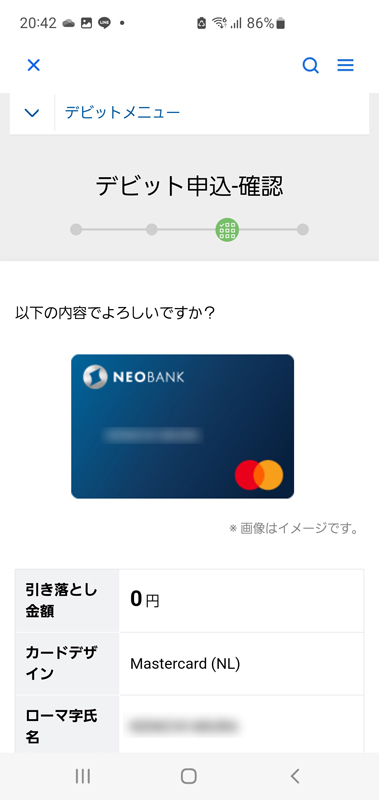

Obtaining a NEOBANK real card (cash card with debit card)

Although NEOBANK allows you to deposit and withdraw money at ATMs using the app "Sumishin SBI Net Bank," it is still more convenient to have a cash card, so I applied for a cash card with debit from the app as shown below. . The initial issuance fee for a cash card with debit card is free until September 30, 2024.

■Issuance procedure for cash card with debit card (real card)

▽Customer information > Card settings > Cards held > Application for cash card with debit card

Deposit to NEOBANK representative account and transfer to SBI hybrid deposit account

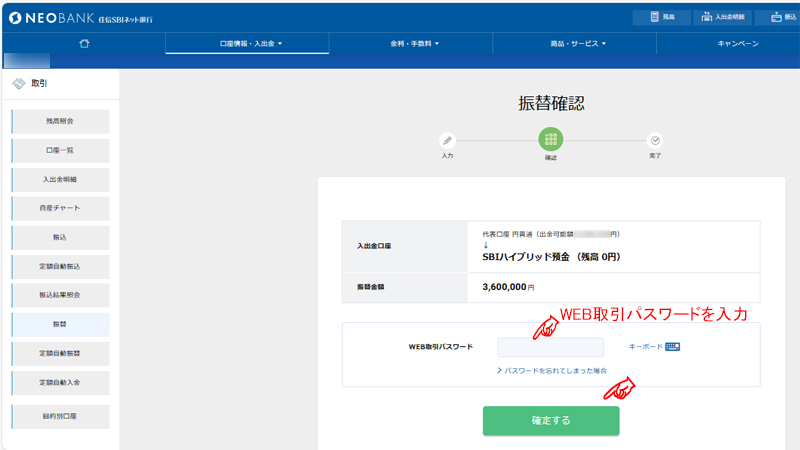

To prepare funds for operating NISA with SBI Securities, first deposit money into the NEOBANK representative account (yen ordinary). Deposit the amount necessary for operation using the debit card you obtained earlier.

Once you have finished depositing money into your representative account, log in from the app or PC site and transfer (transfer) the amount required for NISA cash payment to your SBI Hybrid Deposit Account. To confirm the transfer process, you will need to enter your web transaction password.

Please note that this process is not required for those who only use card payments (only Sumitomo Mitsui Cards can be used) for savings investment.

The example below is an example of transfer processing on a PC site.

Purchase stocks using the NISA investment limit

Purchasing with the NISA accumulation investment limit is recommended for beginners as it uses the dollar-cost averaging method and reduces risk.

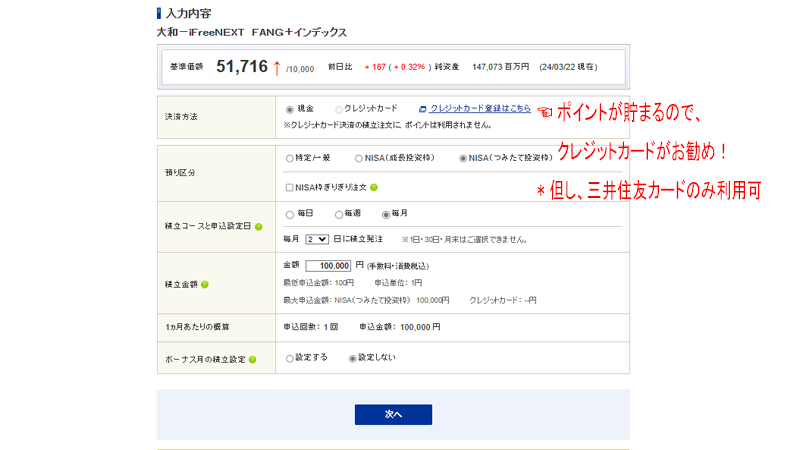

The following is an example of selecting the brand "iFreeNEXT FANG+ Index" from the popular ranking of savings settings and ordering an investment trust product using the accumulated investment limit.

Since this stock does not pay dividends, there is no compound interest effect on long-term savings, but investment profits are reflected in returns.

However, it is a bit of an adventure as it is a risky product with a large return. Therefore, I chose to make a cumulative investment rather than purchasing a lump sum using the growth investment framework.

In addition, with the Nikkei average exceeding 40,000 yen these days, Japanese stock funds such as the "Nikkei Average High Dividend Yield Stock Fund" or "Nomura - Nomura World Industry Investment Series (World Semiconductor Stock Investment)" if you are focused on large returns are recommended. I think that is also an option.

First, access the SBI Securities website and log in ☞ SBI Securities

Open the "Investment Trust (Reserve Purchase)" menu by following the steps below.

"Trading" > "Investment trusts" > "Investment trusts (accumulated purchase)"choose

Select the product for reserve purchase from the "Popular ranking of reserve setting number", enter the payment method, deposit category (NISA accumulation investment limit), reserve course and application setting date (monthly, 2nd), reserve amount, etc., and plan for delivery. After reading the book (investment trust manual), etc., apply for setting up a reserve.

Regarding the application setting date, there seems to be an opinion that it is better to avoid the end of the month or the beginning of the month, as institutional investors often buy at the beginning of the month, and stock prices may rise due to concentrated buying. When I checked the trends in the standard price of each stock, it seems that there is actually little relationship between them. However, in the end, we changed the scheduled order date to the 9th of each month.

In my case, I set the maximum amount of savings at 100,000 yen each month because I don't have any future plans in life, but I think young people can use as much as they can afford each month from their salary, such as 5,000 yen. It is better to invest as little as possible to reduce risk.

If you are aware of the risks and want to make a quick return, you can set the application date to "every month" and set the reserve order date multiple times on different dates when the base price falls. There is also a way to process multiple orders.

If you have a Sumitomo Mitsui Card, you can choose a credit card as a payment method. In that case, the 1st day of each month will be the reserve order date.※

If you pay by credit card, you can also accumulate V points, so I think it's a big advantage. I took this opportunity to proceed with the application process for Sumitomo Mitsui Card at the same time.

Payment method and deposit amount can be changed during the process. In addition, if you wish to cancel your savings, please click the button on the PC site."Trading" > "Investment trusts" > "Investment trusts (accumulated purchase)"You can also cancel the setting of the applicable fund at .

※ 2024.06.03 Added

After the release on Saturday, June 1st, you can now select the order date (application setting date) for credit card accumulation from the 3rd to the 9th of each month. For more information, click here ☞ You will be able to choose the order date for credit card accumulation.

About Yamato-iFreeNEXT FANG+ Index

iFreeNEXT FANG+index is an index fund that allows you to invest intensively in companies that have great influence and high visibility around the world. It includes stocks from 10 stocks listed in the United States, including Facebook and Amazon. This fund is classified as an active fund within Tsumitate NISA.

The ``NYSE FANG+ Index'', which is linked to the iFreeNEXT FANG+ Index, is an index consisting of 10 world-famous technology companies centered on FANG. FANG is a word used to refer to the following four companies collectively.

Facebook (Facebook … Stock name: Meta Platforms)

Amazon (Amazon... Brand name: Amazon.com)

Netflix (Netflix … Stock name: Netflix)

Google (Google … Stock name: Alphabet)

The FANG+ index is made up of a total of 10 stocks, as indicated by the "+" sign, with 6 companies including FANG (4 companies) plus Tesla, Microsoft, Apple, NVIDIA, Broadcom, and Snowflake.

iFreeNEXT FANG+ Index is a convenient investment trust that allows you to invest in concentrated investments in world-famous companies, and it has a good reputation. Even among stocks that are expected to have high growth, it is made up of fewer stocks, so to date it has been lower than the NASDAQ100.high growth rateWe have been proud of this.

In the past, this included Chinese companies Baidu and Alibaba.Recombined in 2022has been carried out, and now it seems that only American companies are involved. Also included was Twitter, which alsoExcluded in 2021it was done. This reorganization is carried out by a governance committee, but there seem to be no firm rules and it is unclear.

In addition, fees are high due to the maintenance costs of the governance committee, and fees seem to be set at about twice that of the NASDAQ100 investment trust.

FANG+ is suitable for medium- to long-term investments, has higher reliability than active funds, and is located between active funds and index funds.

In particular, it is worth noting that NVIDIA, which dominates the world in the development and supply of GPUs and SoCs used in AI, is included.

However, since this fund concentrates investments in specific fields such as IT and semiconductors, there is a high risk, so caution is required.

This fund is characterized by a high yield (annual interest rate +86.91%) and a high fluctuation rate (+19.7% to 110.13%).

According to the prospectus, this fund does not engage in currency hedging, so it is affected by exchange rate fluctuations. The trust fee rate (tax included) is 0.7755% per year.

The average trust fee for index funds announced by the Financial Services Agency is 0.55%, so it can be said that the trust fee is high compared to the average.

The link below isiFreeNEXT FANG+ index accumulation simulation

Obtaining Sumitomo Mitsui Card

As it is a bank credit card, it is a little difficult for someone who is not an office worker to obtain one, but I was able to successfully obtain a Sumitomo Mitsui Card (NL)!

Website “SMBC Sumitomo Mitsui Card” Instant issue menu However, due to insufficient health insurance cards when uploading the two identity verification documents (my number card and health insurance card), the instant issuance service was no longer available, and the application process was switched to the normal application process by mail. .

A week later, on the day I received the envelope to submit my identity verification documents, I uploaded my identity verification documents again, and received an email informing me that I had passed the screening, and my card arrived 4 days later. As a sole proprietor (closed limited liability company in 2016), it may not be possible to issue the card immediately, but if your credit history is good, it seems possible to do so without any problems.

This card will be set up as a debit card account with NEOBANK (SBI Sumishin Net Bank) and will be used for credit card payments for NISA savings purchases. By using your card for payment, you will automatically accumulate V Points. If the amount held in investment trusts (investment trust mileage) is less than 10 million yen, points will be awarded at an annual rate of 0.1% according to the amount held.

In addition, “SBI Securities debut support planBy entering ``, you can earn up to 12,600 yen worth of V points by opening an SBI Securities account and credit card savings (Vpass authentication is required from ``Main Point Settings'' on the SBI Securities website).

[Basic information about Sumitomo Mitsui Card]

Name: Sumitomo Mitsui Card (NL)

Issuing brand: Visa/Mastercard (choose from 3 designs)

Eligible members: 18 years of age or older (excluding high school students)

Annual fee: Free forever

Supplementary insurance: Overseas travel accident insurance of up to 20 million yen

- Also compatible with electronic money (iD, PiTaPa, WAON)! Touch payment also possible

- Perfect security, including a 24-hour card usage monitoring system!

- In the event of unauthorized use, the ``Membership Compensation System'' can compensate for damages up to 60 days from the date of notification of loss or theft.

- Opportunity to upgrade to Sumitomo Mitsui Card Gold (NL) with no annual fee for life if you spend more than 1 million yen (tax included) annually

- Receive 5% points when you pay with Visa touch payment or Mastercard® touch payment at participating convenience stores and restaurants.

- If you pay with Visa touch payment or Mastercard® touch payment on your smartphone, you will receive an additional 2% and 7% points back.

- 0.25% return when charging smartphone app “V Point”, Visa Prepe, and Family Wallet

Purchase stocks with NISA growth investment limit

If you can tolerate high risk and are able to judge stocks and buy/sell timing yourself, you may consider investing in a lump sum. Lump-sum investments have higher risks than cumulative investments, so you may incur large losses. Therefore, avoid investing a lump sum of money that exceeds your risk tolerance or using more than your available funds.

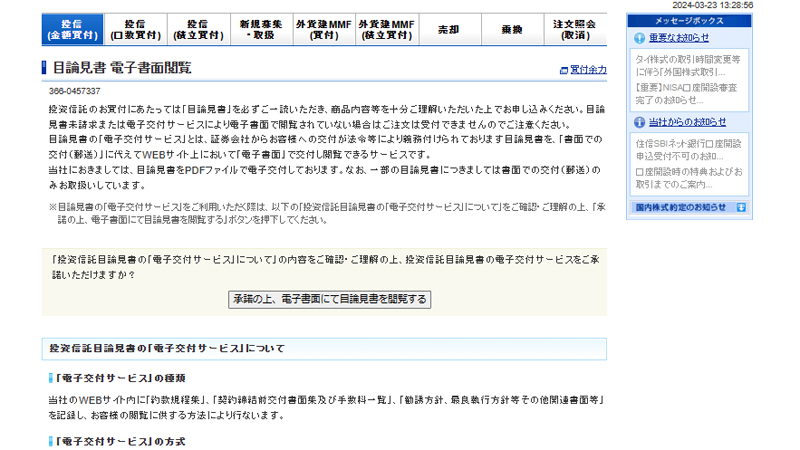

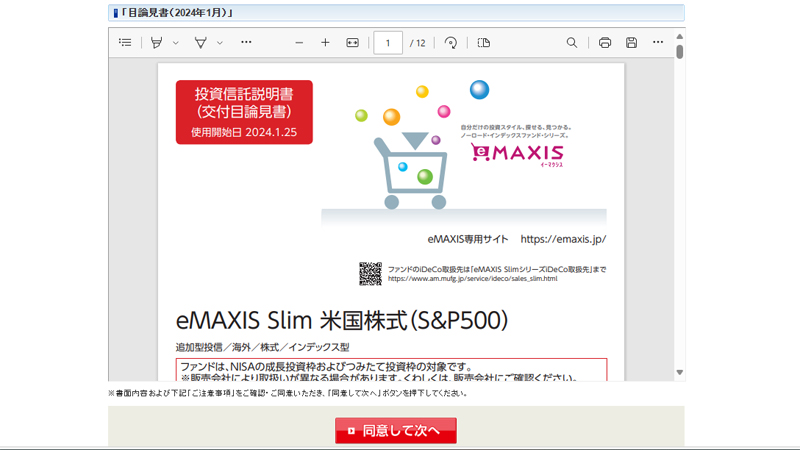

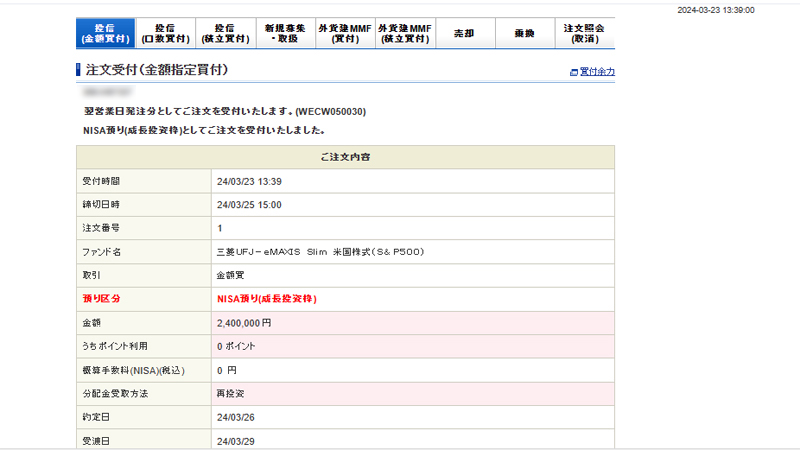

Below, select the brand "eMAXIS Slim US stocks (S&P 500)" from the NISA ranking weekly purchase amount (growth investment limit + accumulation investment limit), and use the growth investment limit to buy investment trust products by "amount purchase". This is an example when ordering.

Regarding the large amount of the annual investment limit, as mentioned above, Main types of investment trusts and investment model cases Based on our opinion, we selected stable US stocks.

First, access the SBI Securities website and log in ☞ SBI Securities

Normally, the following operation will open the "Investment trust (specified amount purchase)" menu, but in the gallery below, you will be able to select from the NISA ranking.

"Trading" > "Investment Trusts" > "Investment Trusts (Specified Amount Purchase)"choose

Select the purchase amount for the product selected from the NISA ranking's "Weekly purchase amount (growth investment limit + accumulation investment limit)", read the prospectus (investment trust manual), and then select the deposit category "NISA deposit ( Enter "Growth investment limit)", purchase amount, and method of receiving dividends, and apply for an order with a specified amount purchase.

In addition, V points can be applied to the purchase amount in a specified amount purchase (not possible in a reserve purchase).

Bulk purchases using the NISA growth investment framework are expected to yield large returns due to large price fluctuations, but there is also the risk of the stock being significantly below cost, so care must be taken when selecting stocks.

In particular, if you are new to investing, we recommend choosing investment trust products rather than individual stocks. In any case, if you do not hold it for a long time, you will not be able to make a profit, but you should be prepared for the risks.

Please note that if you purchase a large amount at once, the standard price will drop immediately and you may incur a large loss. Therefore, although it is very difficult to make predictions due to complex factors such as the world situation, by looking at the timing of the price drop as much as possible and making purchases in several installments at a certain period of time, you can increase the number of units purchased and I think there are approaches to reduce risk.

However, if it is a fund whose standard price trend is increasing steadily, I think it is better to put a large amount of money into the fund at once, as the return will increase faster.

About eMAXIS Slim US Stock (S&P500)

eMAXIS Slim 米国株式(S&P500) is a recommended stock that allows you to diversify your investment in US stocks at low cost.

連動対象である「S&P500指数」は、アメリカの代表的な企業500社から構成されます。つまり、この銘柄に投資すれば、経済大国アメリカの主要な株をまるごと買うのと同じようなリターンを得られることを意味します。

This stock is part of the eMAXIS Slim series, which continues to aim for the lowest operating costs in the industry. Additionally, a system called beneficiary return type trust compensation has been adopted. The more the total net assets (funds managed by investment trusts) increase, the lower the operating costs will be.

This fund is characterized by a high yield (annual interest rate +49.00%) and a low fluctuation rate (+4.34% to 49%).

According to the prospectus, this fund does not engage in currency hedging, so it is affected by exchange rate fluctuations. The trust fee rate (tax included) is 0.09372% per annum, which is set quite low compared to other funds.

The link below iseMAXIS Slim U.S. stocks (S&P500) accumulation simulation

2024.05.23 Added

Currently, the NASDAQ100, which is centered on high-tech stocks, is performing well, so I decided to move from an S&P500 index fund to a fund based on the NASDAQ100.

Therefore, I sold most of the "eMAXIS Slim U.S. Stocks (S&P 500)" fund, and although it falls under the taxable limit, it is sold in a special account.Nissay NASDAQ Q100 Index Fund” funds are managed.

From next year, the NISA framework will include the "Nissay NASDAQ100 Index Fund," "Daiwa-iFreeNEXT FANG+ Index," and "Nissay SOX Index Fund (US semiconductor stocks)”, and furthermore, a new investment trust “Tracers S&P500トップ10インデックスWe plan to mainly manage the fund.

なお、S&P500トップ10とFANG+の組入比率は大きな違いがあり、S&P500トップ10は時価総額荷重平均(構成銘柄の時価総額の合計値を基準時点での時価総額合計で割った値)、FANG+は均等加重平均(すべての構成銘柄を均等に配分する)で構成されています。

S&P500トップ10とFANG+はどちらも構成銘柄の入れ替え、構成比率の調整は年4回行われます。

構成銘柄の入れ替えは、S&P500トップ10は時価総額に応じてすべての銘柄が入れ替え対象なのに対して、FANG+の方は名前の通り、F(メタ・プラットフォーム 旧Facebook)、A(アマゾン・ドット・コム)、N(ネットフリックス)、G(アルファベット 旧Google)は固定されていて、それ以外の6社が入れ替え対象となります。

Regarding trust fees, the trust fees for Nissay NASDAQ100 are:Annual rate 0.2035%, Nissay SOX Index Fund (US semiconductor stocks)Annual rate 0.1815%、Tracers S&P500トップ10の信託報酬はAnnual rate 0.10725%, iFreeNEXT FANG+ trust fee isAnnual rate 0.7755%Is.

How to check your order status

Investment trusts are reflected in your account management in the early hours of the morning following the trade date, but depending on the brand, the funds may not be reflected even the day after the order date.

You can check the order status and execution date of the order in progress by following the steps below.

After logging into the SBI Securities PC site,

"Trading" → "Investment trusts"→Select “Order Inquiry (Cancellation)” → “Investment Trust”/“Accumulated Purchase/Regular Sale”

By the way, the brand name "Mitsubishi UFJ-eMAXIS Slim US Stock (S&P500)" was not reflected in account management even the next day.

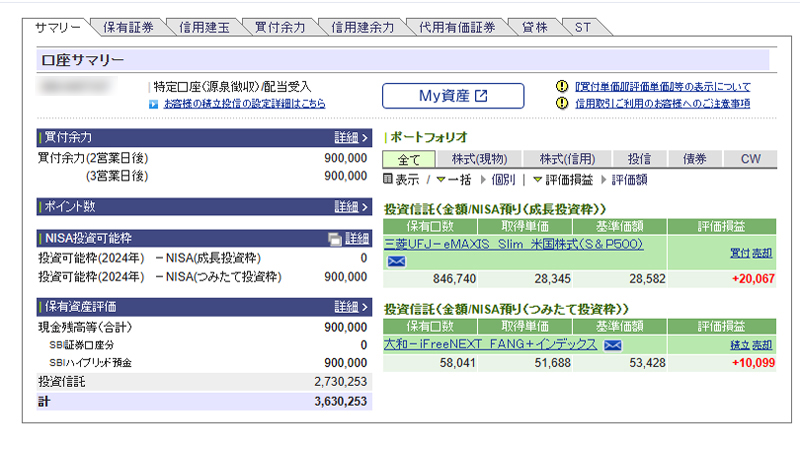

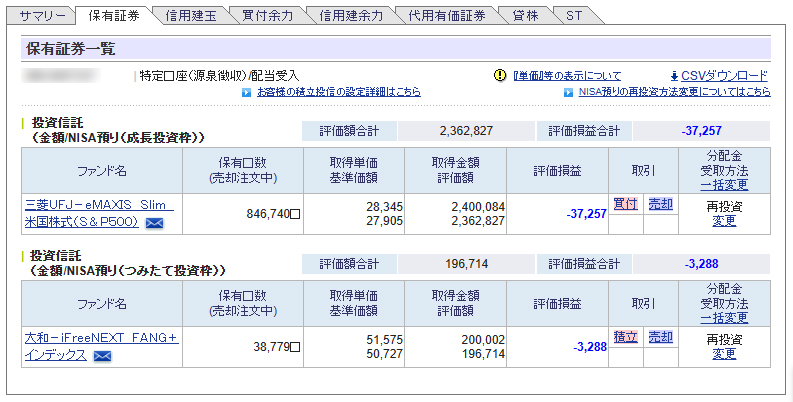

Confirmation of assets held

Once the investment trust contract is fulfilled, the invested amount will be reflected in the account management.

You can check your assets by following the steps below.

After logging into the SBI Securities PC site, select "Account Management"

The gallery below shows the account management screen about three weeks after purchasing an investment trust product (growth investment limit). To display graphs of asset trends, more than two weeks' worth of data is required.

The standard price listed on securities held generally corresponds to the unit price per 10,000 units. Therefore, the valuation amount can be calculated as follows.

Number of units x standard price ÷ 10,000 = Appraised value

As shown below, the unrealized gains and losses on April 5th are as follows for the two stocks:-40,545 yenIt was a big loss 💦

This comes in response to US Federal Reserve officials taking a cautious stance on the outlook for interest rate cuts the day before, and President Biden's telephone conversation with Israeli Prime Minister Netanyahu regarding the Gaza conflict. This is said to be due to the request for a cease-fire and awareness of geopolitical tensions.

The day ended with all three major U.S. stock market indexes down more than 1%. The S&P 500 index has fallen the most since February 13th.

Although such fluctuations are temporary, if you invest a large amount in the growth investment framework, the amount of loss will be large and the shock will be correspondingly large. The only thing we can do is wait patiently for a recovery, without getting too excited or worried about the ever-changing valuation gains and losses. I don't think there will be any results if you don't salt for at least a year or more.

Well, as for index funds, if the standard price chart is generally rising, I think it's okay for the time being...

However, when investing in a lump sum with a NISA account, whether or not there is no loss even if you hold it for more than one year depends on the fluctuations in the market price of the stock you are investing in. The stock market is highly unpredictable, and prices can go up or down. Therefore, if the market price declines after making a lump sum investment, you may incur a loss.

Under the new NISA system, there is no longer a tax-exempt period, and if you sell and your investment space becomes available, you can reinvest tax-free again, so it is possible to quickly discard investments with poor expectations and minimize losses. It is considered valid. In addition, especially when investing in individual stocks, by selling quickly before the stock price drops significantly, you can avoid the occurrence of "salted stocks" with large unrealized losses and minimize the loss of tax savings. .

Risk management is important when investing, as sales losses incurred in NISA accounts cannot be included in profit or loss and become losses. Investments must be made at one's own risk, and investment decisions must be made carefully based on one's own investment objectives and risk tolerance, always taking into account not only profits but also the possibility of losses.

What if the securities company goes bankrupt?

Finally, I would like to write about this question just in case.

The following is an explanation of SBI Securities' "return of customer assets."

in short"Assets deposited with NISA are protected, so even if the securities company goes bankrupt, there is no need to worry.” That means.

Even in the unlikely event that a securities company goes bankrupt (its registration as a securities company is revoked, a bankruptcy petition is filed, etc.), if the securities company properly performs "separate management," which securities and money will go to which customers? Since it is clear that the securities and money entrusted to us will be returned to the customer without fail. Even in the unlikely event that our company goes bankrupt, the assets (securities and money) entrusted to us by our customers are managed separately, so they will be returned to our customers without fail. However, the time lag (※), or in the unlikely event that the customer's assets cannot be completely returned due to an accident, or if it takes a significant number of days to return the customer's assets, the Investor Protection Fund will respond.

SBI Securities | Stocks, FX, Investment Trusts, Defined Contribution Pensions, NISA (sbisec.co.jp)

*The protection fund will not compensate for margin trading, futures trading, options trading, exchange stock index margin trading (Click Kabu 365) unsettled positions and their unrealized profits, foreign exchange margin trading unsettled positions and deposited margins, etc. there is no.