Last updated: March 11, 2023 at 3:09 PM

Last updated: March 11, 2023 at 3:09 PM

10 years in total*1 Over the years, when I was running an IT company (computer software development), it was accounting software for corporations. Sorimachi 'Accounting King'*2 was using

Accounting King's sales price is not so expensive, it is easy to operate with a GUI that is faithful to bookkeeping, and it also supports departmental accounting, so it is recommended accounting software.

Currently, I have switched from a corporation to a sole proprietorship, so my accounting software is also Sorimachi's "Everyone's Blue Return"*3 We are using

*1 Store labyrinth is 11 years including the overlap period *2 Suggested retail price: 44,000 yen (tax included) *3 Suggested retail price: 10,780 yen (tax included)

As described in the article below, currently my company is in a dormant state. Considering the benefits such as the enjoyment of the benefits such as the fact that you have already received it, I think it was a good choice to choose the blue color.

In May 2017, I submitted a notice of opening of business as a sole proprietor to the tax office at the same time as my notice of business suspension.

At that time, in order to receive a deduction of 650,000 yen for blue returns, we have already submitted a return for electronic book storage. In addition, in order to receive the 650,000 yen deduction for the blue tax return, it is a prerequisite that the tax return is filed by e-Tax or the electronic book is saved.

For blue returns, it is also mandatory to submit financial statements (balance sheet, profit and loss statement) prepared by double-entry bookkeeping.

As for bookkeeping, even if there is no cash movement, it is necessary to adopt an accrual basis method (accounts receivable, accounts payable, etc.) that records transactions at the time they occur, so minimum knowledge of bookkeeping is required for bookkeeping. You can

In this article, we will introduce Sorimachi's accounting software "Everyone's Blue Return" and the program "Everyone's Tax Return", which automatically creates tax returns, and how to use them.

everyone's blue return

"Everyone's Blue Return" sold by Sorimachi Co., Ltd. is software exclusively for sole proprietors specializing in final tax returns, and is accounting software that can automatically create blue return financial statements with simple operations.

You can use it with confidence because it is fully compatible with the revised electronic book storage law and the invoice system. In addition, "Account King", which is also sold by Sorimachi, has various analysis functions in addition to supporting the accounting work required for corporate settlement.

* The operating environment of Everyone's Blue Declaration is as follows. Supported OS is Windows only, not Mac OS.

Windows 11(64bit)Windows

Operating environment for blue return software “Everyone's Blue Return”|Sorimachi Co., Ltd. (sorimachi.co.jp)

Windows 10(64bit/32bit)

Windows 8.1(64bit/32bit)

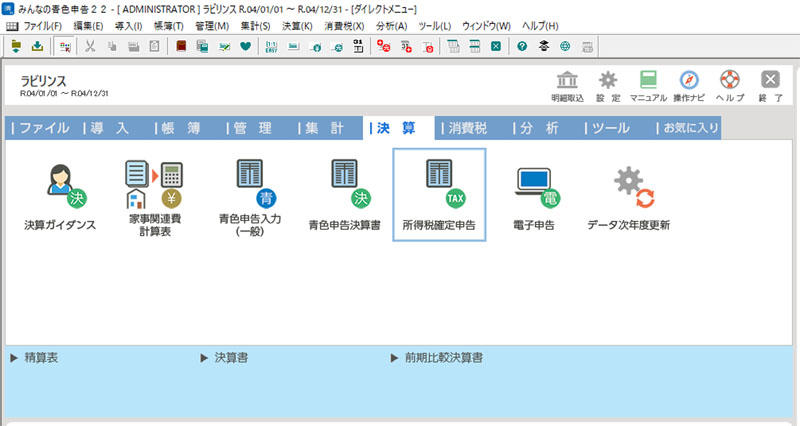

Hereafter, we will explain the main operation methods after creating the initial data for the ledger of "Everyone's Blue Return".

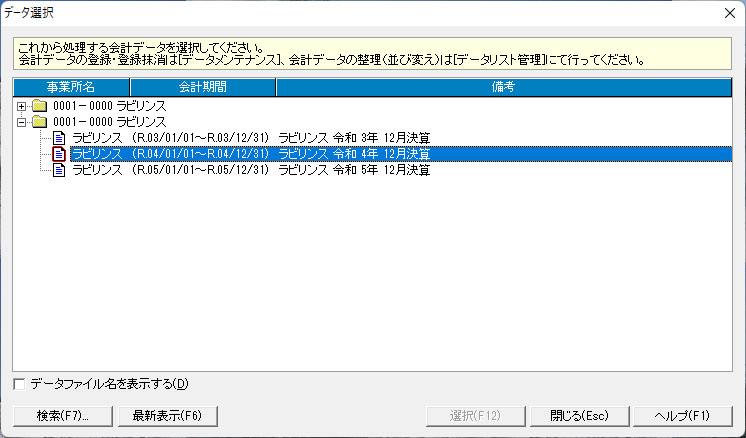

data selection

Select the saved ledger data. To create new data, select "File" ⇒ "New".

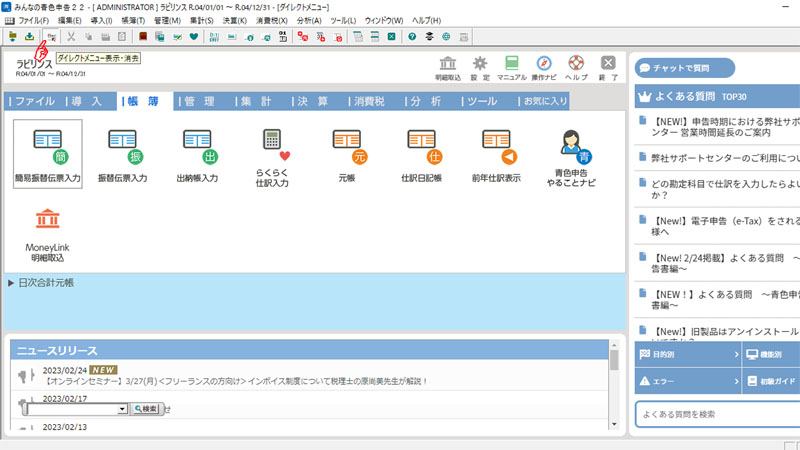

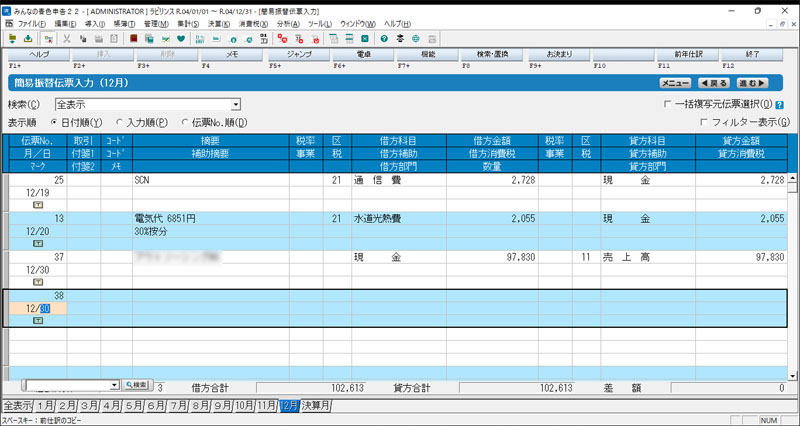

entry in the books

Entries to the ledger are usually performed using a "simple transfer slip".

You can use the blue for entertainment expenses that are not allowed on the white tax return. However, although this is the same for corporations, the full amount of utilities used at home and office is not certified, so the amount calculated on a pro rata basis will be allocated (state the details in the supplementary remarks column).

Account items are set at the time of initial setting, but if you want to add them in the middle of the process, you can do it from "Introduction" ⇒ "Account setting" in the menu.

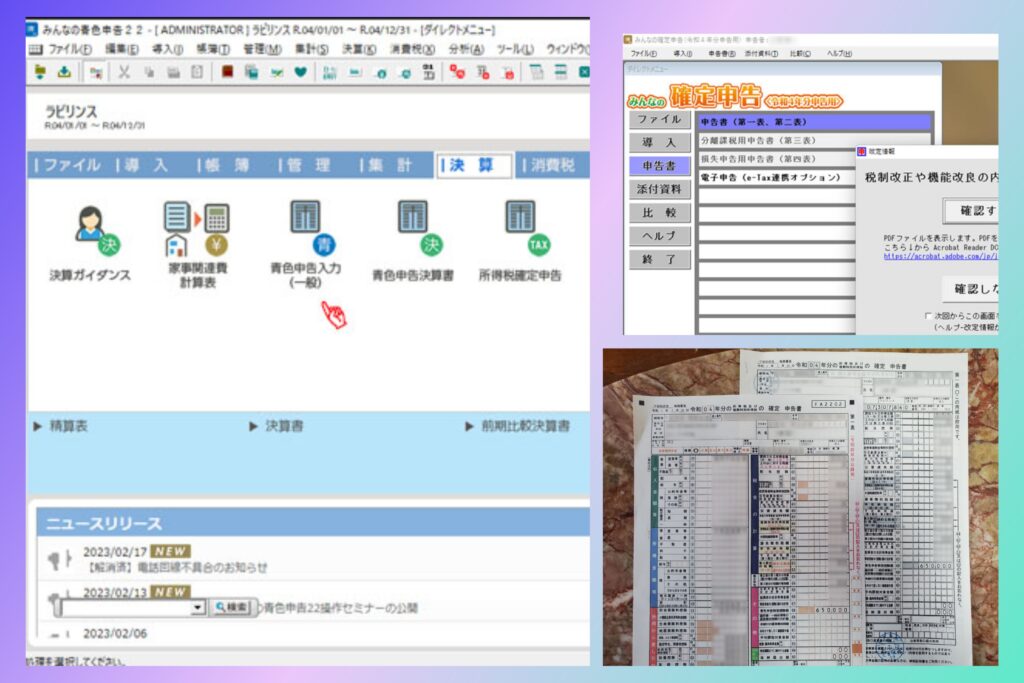

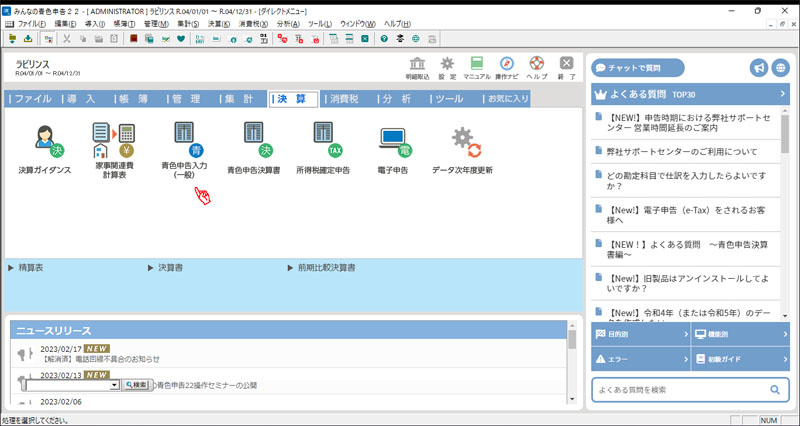

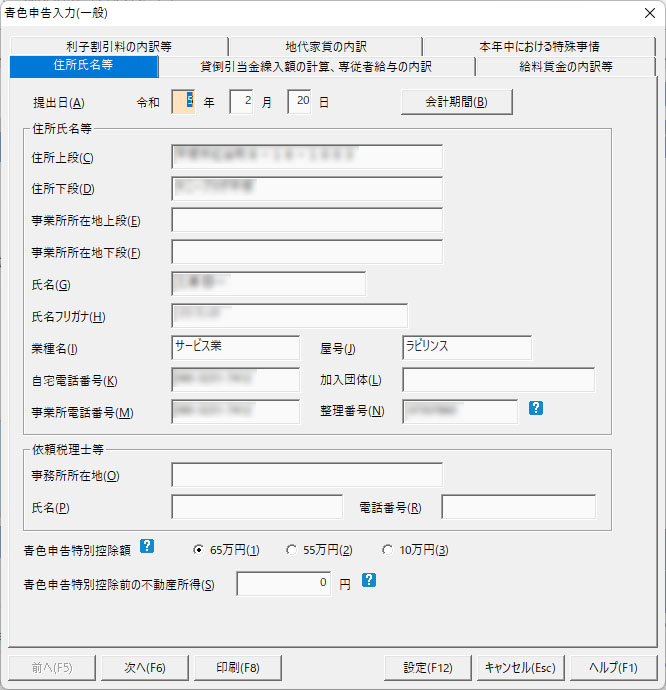

Data entry for blue return

Enter the data for creating a blue return from the "Blue return input (general)" menu.

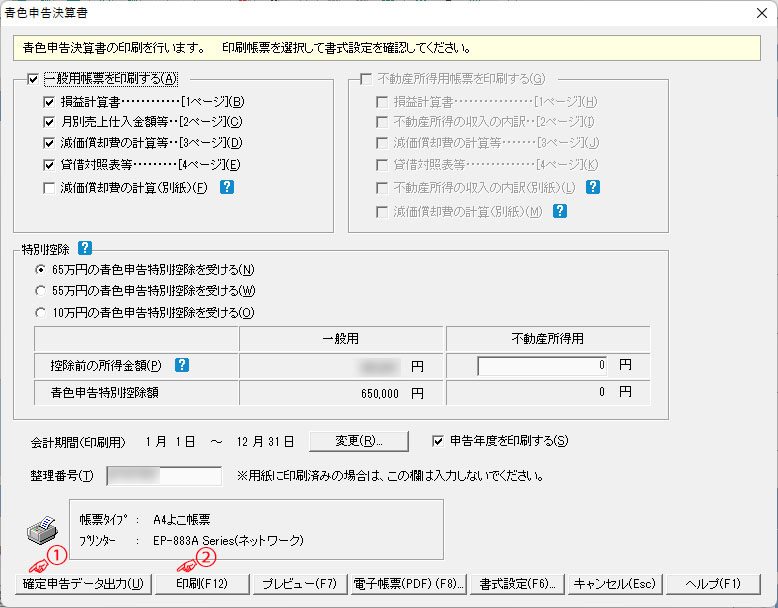

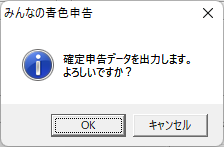

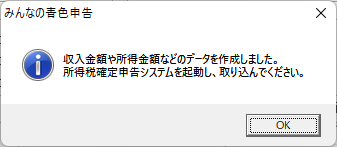

Data output and printing of blue tax returns

After outputting final tax return data from the menu of "blue return financial statement", check "print tax return year" and print the blue return financial statement.

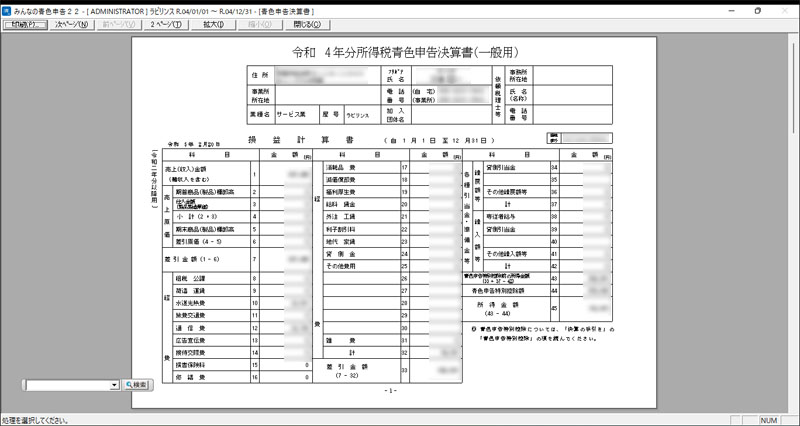

Data update next year

After closing the accounts, carry over the accounting data to the next fiscal year from the menu of "Data next year update" as follows.

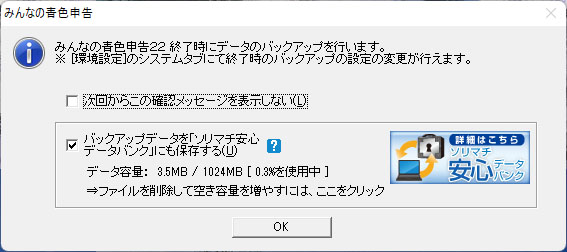

If you have an annual maintenance contract "Value Support" (6,600 yen per year) with Sorimachi, you can back up your accounting data to the cloud (Sorimachi Anshin Data Bank) when you save the data.

In that case, even if the PC HDD crashes and the accounting data is destroyed, the accounting data can be restored from the cloud backup.

By the way, in my case, I have HDD mirroring software installed in my PC, and I have an automatic backup of accounting data even in a local environment.

everyone's tax return

In order to prepare a final tax return, a "Value Support" contract with Sorimachi is required. If you subscribe to Value Support, in addition to the income tax return program "Everyone's final return", the e-Tax linkage option "Everyone's electronic return" and the next latest version "Everyone's blue return" will be provided free of charge.

In addition, since it will be possible to back up accounting data to the cloud, most people seem to continue their Value Support contracts.

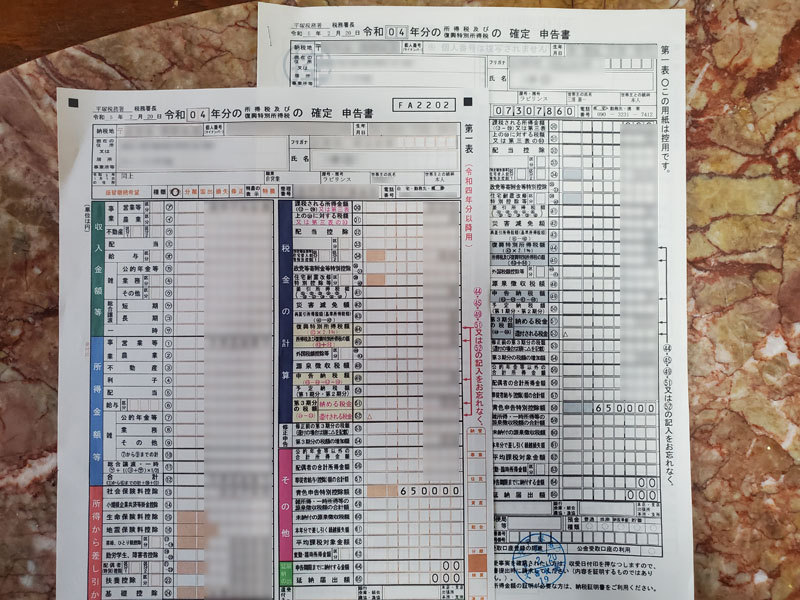

Compared to corporations, the individual business owner's final tax return has less space to fill in and is relatively simple, so I used to submit it by hand every year, but I found that using the automatic preparation makes it even easier. I decided to continue with value support.

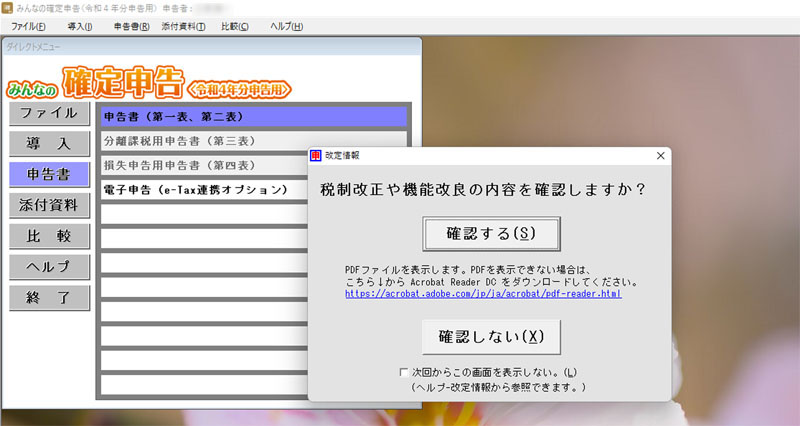

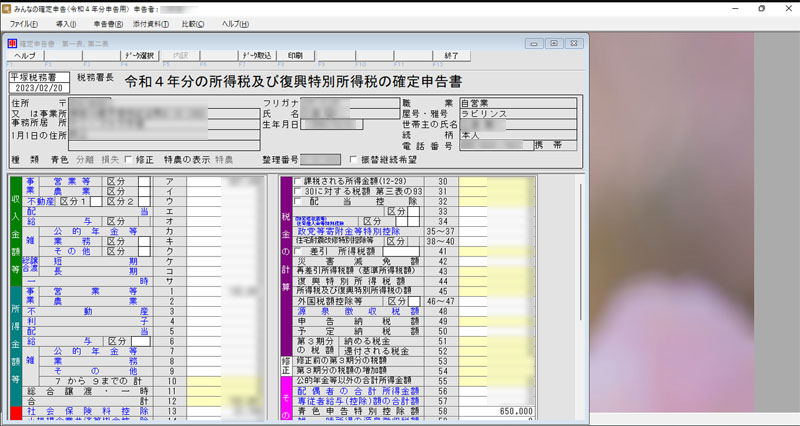

Tax return printing

If you have signed up for Sorimachi's Value Support, you can download the "Everyone's Tax Return" program from the Sorimachi website. After installation, you will be able to start the "Everyone's final tax return" program from the "Everyone's blue return" menu "Income tax return".

To print your tax return, follow the steps below. The format of the final tax return corresponds to the annual revision of the National Tax Agency. When printing is executed, two tax return forms for submission (color) and copy (monochrome) will be output.